The Rise of Fintech Banks: Why They Will Take Over Commercial Banks

The Rise of Fintech Banks: Why They Will Take Over Commercial Banks

The financial industry is undergoing a profound transformation, driven by technological advancements and changing consumer preferences. Fintech banks, also known as neobanks, are emerging as formidable competitors to traditional commercial banks. This article explores the reasons behind the rise of fintech banks and why they are poised to take over the commercial banking sector.

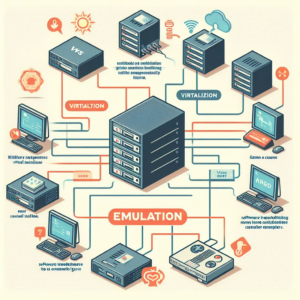

One of the primary reasons fintech banks are positioned to overtake commercial banks is their agility and innovation. Fintech banks leverage technology to streamline operations and deliver financial services with unprecedented speed and efficiency. They are not weighed down by legacy systems and bureaucracy, enabling them to adapt quickly to market changes and consumer demands.

Commercial banks, on the other hand, often struggle with legacy infrastructure and outdated processes. This impedes their ability to innovate and respond to market shifts. Fintech banks continuously develop and launch new products and features, attracting customers seeking cutting-edge financial solutions.

Customer-Centric Approach

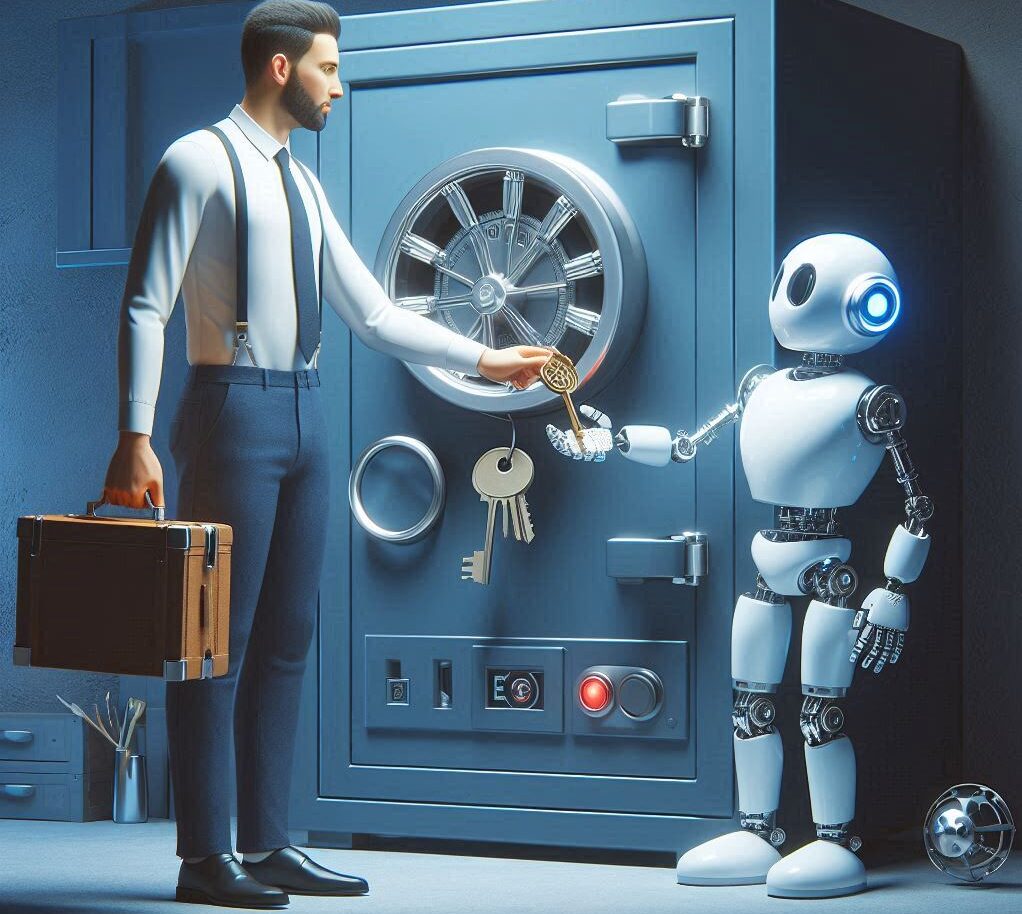

Fintech banks prioritize customer experience and customization. They use data analytics and artificial intelligence to understand customer needs better, enabling them to offer tailored solutions. Personalization, easy-to-use mobile apps, and 24/7 customer support are hallmarks of fintech banks, making them more appealing to digital-savvy consumers.

Commercial banks, historically, have operated on a one-size-fits-all model. While they have improved their digital offerings in recent years, they often fall short of the seamless and personalized experiences that fintech banks provide. This customer-centric approach gives fintech banks a competitive edge.

Cost-Efficiency

Fintech banks have significantly lower operational costs compared to their traditional counterparts. They don’t have the overhead expenses associated with maintaining physical branches and extensive staff. This cost-efficiency allows fintech banks to offer better interest rates, lower fees, and higher returns on savings accounts, attracting cost-conscious consumers.

Commercial banks must contend with the high costs of maintaining brick-and-mortar locations and large staff numbers. This limits their ability to compete on pricing, making them less attractive to cost-conscious consumers.

Global Reach

Fintech banks often operate across borders with ease, facilitating international transactions and providing global services. They eliminate the need for currency exchange fees and offer competitive forex rates, which is especially beneficial for businesses engaged in international trade.

Commercial banks typically have a more limited global reach and may charge higher fees for cross-border transactions. Fintech banks’ global accessibility is appealing to businesses and individuals engaged in international finance.

Ecosystem Partnerships

Fintech banks are known for forming partnerships with various fintech companies and creating ecosystems that offer a wide range of financial services under one roof. These partnerships provide customers with access to investment platforms, insurance, and other financial products seamlessly through a single app or platform.

Commercial banks, although they have the resources to establish similar partnerships, often struggle to do so due to complex organizational structures and legacy systems. Fintech banks’ ability to create integrated ecosystems enhances their appeal to customers looking for comprehensive financial solutions.

SUMMARY

Fintech banks are not just a trend; they are the future of banking. Their agility, innovation, customer-centric approach, cost-efficiency, global reach, and ecosystem partnerships are pushing them to the forefront of the financial industry. While traditional commercial banks have their strengths, they must adapt and innovate to keep up with the rapidly evolving fintech landscape. The rise of fintech banks signals a fundamental shift in the banking sector, and their ability to take over commercial banks is increasingly likely as consumers continue to embrace the benefits of digital finance.

Post Comment